Tracking your tax refund because of the various steps involved in the process can prove to be such a hard task. Many taxpayers make mistakes in tracking their tax refunds, therefore causing delays in getting their money back.

Make sure to avoid pitfalls, and this is the best way to do it.

Common Pitfalls

When tracking your tax refund, it’s important to be aware of common mistakes that can cause delays:

- Incorrect Information: A lot of times, people tend to enter wrong information in their returns. This may include their Social Security number, bank account information, or any other personal information that is not necessarily false.

- Not Checking the Status Regularly: The failure to regularly make checks on the status of the taxpayers can lead to big problems since they can easily be left out of key changes and notifications regarding their refund process. You should always be fully alert to the status of your refunds.

- Ignoring Notifications: Ignoring messages or notifications from the tax authorities can really slow the process. Normally, these notifications contain important information about your refund status and required actions.

Tips to Avoid Pitfalls: Turbocharge Your Refund

To avoid these common pitfalls, follow these simple tips:

- Double-Check Your Information: Before submitting your tax return, verify all details to ensure accuracy. This includes your personal information, income details, and deductions.

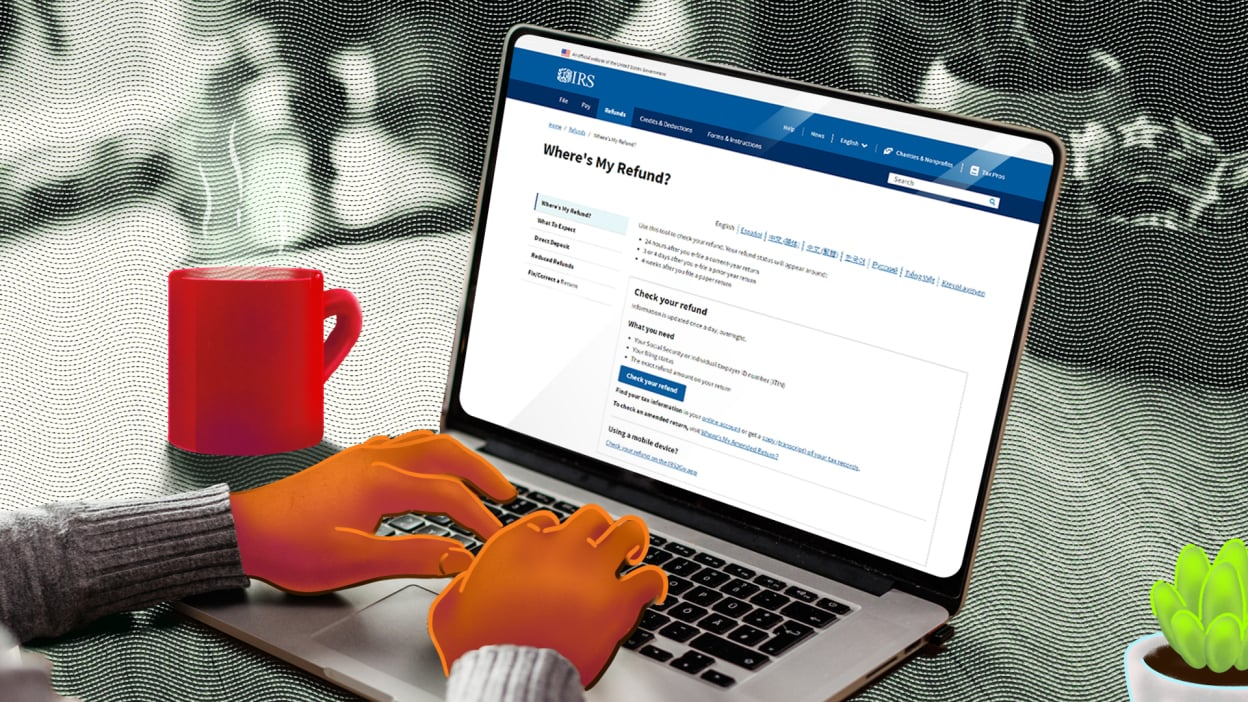

- Use Reliable Tools: Utilize trusted websites and apps to track your refund. These tools provide accurate and up-to-date information about your refund status.

- Stay Informed: Regularly check for updates and notifications from the tax authorities.

Avoiding these pitfalls can help you get your refund faster and with less hassle.

For more tips on refund status secrets and how to turbocharge your refund, visit the Easy Tax Filing Website. They offer reliable tools and expert advice to make tax filing easy and stress-free.